|

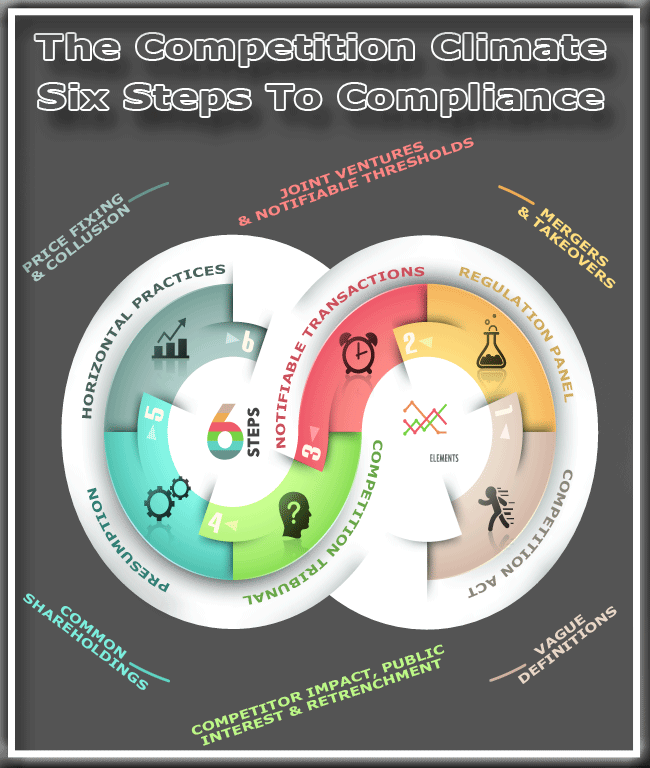

The competition climate in South Africa is fairly heavily regulated, with prevailing competition laws being enforced and developed by the Competition Commission together with the Competition Tribunal and the Takeover Regulation Panel. In enforcing its mandate, the Commission prohibits certain activities between competitors (so-called “horizontal practices”), such as price fixing and collusion.

The competition legislation goes as far as to presume the presence of these prohibited activities, where certain common shareholding exists between entities. While the prevailing competition legislation defines transactions that require prior notification and/or approval of the Commission, determining whether a transaction should be notified to the Commission can be confusing, owing largely to the wide definition of “merger” in the Competition Act. For example, a joint venture arrangement (whether incorporated or not) which meets the notifiable financial thresholds will require Competition Commission approval. Moreover, the approval of the Takeover Regulations Panel will be required to be obtained in circumstances where, pursuant to an intended merger, more than 10% of the entity’s shares have been disposed of within the previous 24 month period.

The Competition Tribunal will approach approval requests by among other things, determining the likely impact of the proposed transaction on competition in the relevant market. Additionally, the Commission will evaluate whether any public interest issues arise from the proposed transaction. A matter of public interest would, for example, include a circumstance where the purposed transaction results in a retrenchment of a class of employees.

|